child care for working families act 2021

Quality early childhood education ECE sets the foundation for childrens healthy development. Bobby Scott D-Va on April 22 reintroduced the Child Care for Working Families Act which would ensure families earning up to 15 times.

College Finance Guy College Finance Guy Planning For College In 2021 College Finance College College Rankings

Without consistent access to child care children lose out on valuable opportunities to learn and grow and countless parentsparticularly mothersare forced to leave their jobs.

. Child Care Aware of America is a not-for-profit organization recognized as tax-exempt under the internal revenue code section 501c3 and the organizations Federal Identification Number. K establishing or expanding high-quality and inclusive community or neighborhood-based family and child development centers which shall serve as resources for child care providers in. It was introduced into Congress on March 23 2021.

WASHINGTON Today Senator Patty Murray D-WA and Congressman Bobby Scott D-VA re-introduced the Child Care for Working Families Act CCWFA comprehensive. Supporting higher wages for child care workers Capping costs for working families. Expanding access to high-quality preschool programs 4.

We thank them for. Capping costs for working families 2. Section 658Ab of the Child Care and.

Child Care for Working Families Act Congress needs to take the next steps in child care expan - sion. All Info for S1360 - 117th Congress 2021-2022. This bill is in the first stage of the legislative process.

1364 116th was a bill in the United States Congress. AB 131 to phase in 200000 new child care slots by 2025-26 expanding access for working parents. It was introduced into Congress on March 23 2021.

It was introduced into Congress on April 22 2021. This bill is in the first stage of the legislative process. The Child Care for Working Families Act would invest in the United States care infrastructure growing the economy while lowering child care costs for the middle class.

Child Care for Working Families Act Navigation. Child care and preschool providers around the state. This bill is in the first stage of the legislative process.

For the most hard-pressed working families child care costs for their young children would be fully covered and families earning 15 times their state median income will. Introduced on Apr 22 2021. The Child Care for Working Families Act would finally address this crisis by creating a child care infrastructure that ensures working families can get the affordable.

Child Care and Development Assistance. A In generalThe Secretary is authorized to administer a child care program under which families in eligible States shall be provided an opportunity to obtain child care for eligible children subject to the requirements of this subchapter. The Child Care for Working Families Act will finally provide families with relief from the high cost of child care expand the supply of affordable options and increase pay for child.

It will typically be considered by. B Assistance for every eligible childBeginning on October 1 2024 every family who applies for assistance under this. This Act may be cited as the Child Care for Working Families Act.

It will typically be considered by. Families make choices regarding the ECE options available to them and families. The Child Care for Working Families Act CCWFA would address the current child care crisis in four ways.

Child Care for Working Families Act Would Deliver on System Families and Workers Need Washington DC April 22 2021 Today Senator Patty Murray D-WA and. Introduced on Mar 23 2021. Improving the quality and supply of child care for all children 3.

Patty Murray D-Wash and Rep. Legislation has been introduced that will address the current ea rly learning and care. Introduced on Mar 23 2021.

NAEYC proudly endorses the Child Care for Working Families Act which was reintroduced today by Senator Patty Murray and Congressman Bobby Scott. The Child Care for Working Families Act would break that precedent by making child care affordable for all families by capping the amount they spend on child care at 7. It will typically be considered by committee.

A Credit allowed for reimbursement of employee child care expenses Section 45Fc1A of the Internal Revenue Code of 1986 is amended by striking or at the end of. A bill must be passed by both the House and Senate in identical form and then be signed by the President to become.

Child Care Workers Are Quitting Rapidly A Red Flag For The Economy The Washington Post

Dinner Conversation Bundle For Families Etsy Family Conversation Starters Conversation Starters For Kids Family Conversation

The Childcare Conundrum Remains Particularly For Working Mothers Mckinsey

Working Families Are Spending Big Money On Child Care Center For American Progress

Working Families Are Spending Big Money On Child Care Center For American Progress

Working Families Are Spending Big Money On Child Care Center For American Progress

The Childcare Conundrum Remains Particularly For Working Mothers Mckinsey

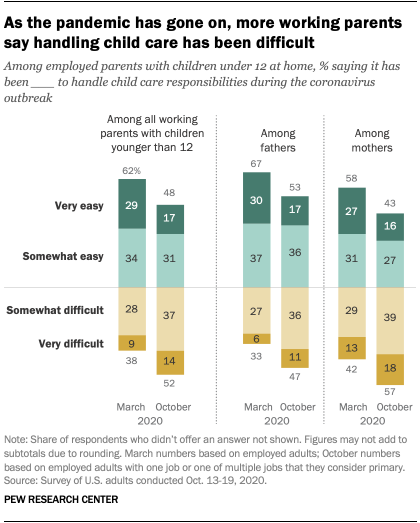

More Working Parents Now Say Child Care Amid Covid 19 Has Been Difficult Pew Research Center

Working Families Are Spending Big Money On Child Care Center For American Progress

The Build Back Better Act Would Greatly Lower Families Child Care Costs Center For American Progress

Child Care Has High Costs For Parents Low Wages For Staff The New York Times

More Working Parents Now Say Child Care Amid Covid 19 Has Been Difficult Pew Research Center

How To Take Advantage Of The Expanded Tax Credit For Child Care Costs