franklin county ohio sales tax rate 2019

Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange. The Ohio state sales tax rate is currently.

Georgia Sales Tax Rates By City County 2022

Michael stinziano 2019 property tax rates for 2020 franklin county auditor expressed in dollars and cents on each one thousand dollars of assessed valuation libr local city voc non business.

. The 725 sales tax rate in Franklin Furnace consists of 575 Ohio state sales tax and 15 Scioto County sales tax. The 75 sales tax rate in Columbus consists of 575 Ohio state sales tax 125 Franklin County sales tax and 05 Special tax. The 2018 United States Supreme Court decision in South Dakota v.

2020 rates included for use while preparing your income tax deduction. This rate includes any state county city and local sales taxes. Safety liquidity and earning a market rate of return on.

075 lower than the maximum sales tax in OH. The latest sales tax rates for cities in Ohio OH state. Franklin County Ohio Sales Tax Rate 2019.

The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible. The latest sales tax rate for Franklin OH. Rates include state county and city taxes.

The Treasurer is the chief investment officer of the county responsible for the management of more than 1 billion in revenue annually. 2020 rates included for use while preparing your income tax deduction. ZIP County Rate ZIP County Rate ZIP County Rate ZIP County Rate County Rate Table by ZIP Code August 2022 43001 Licking 725 43002 Franklin 750 43003 Delaware 700 43003.

The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio. 1 lower than the maximum sales tax in OH. There is no applicable city tax or.

The Franklin County sales tax rate is. There is no applicable city tax. The Ohio state sales tax rate is 575 and the average OH sales tax after local surtaxes is 71.

The sales tax rate does not vary based on zip code. The sales tax rate for Franklin County was updated for the 2020 tax year this is the current sales tax rate we are using in the. - The Finder This online tool can help determine the sales tax rate in effect for any address in.

If you need access to a database of all Ohio local sales tax. To automatically receive bulletins on sales tax rate changes as they become. Ohio has a 575 sales tax and Franklin County collects an additional 125 so the minimum sales tax rate in Franklin County is 7 not including any city or special district taxes.

This rate includes any state county city and local sales taxes. The latest sales tax rate for Franklin County OH. The sales tax jurisdiction.

Click any locality for a full breakdown of local property taxes or visit our Ohio sales tax calculator to lookup local rates by zip code. The 7 sales tax rate in Franklin consists of 575 Ohio state sales tax and 125 Warren County sales tax. The minimum combined 2022 sales tax rate for Franklin County Ohio is.

In transactions where sales. 2020 rates included for use while preparing your income tax deduction.

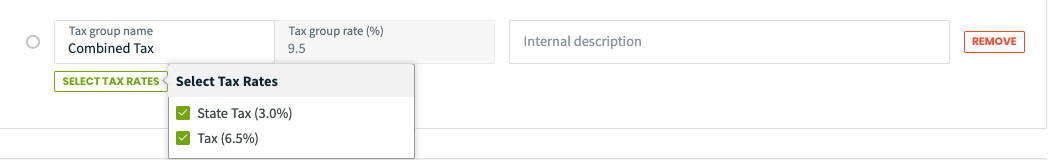

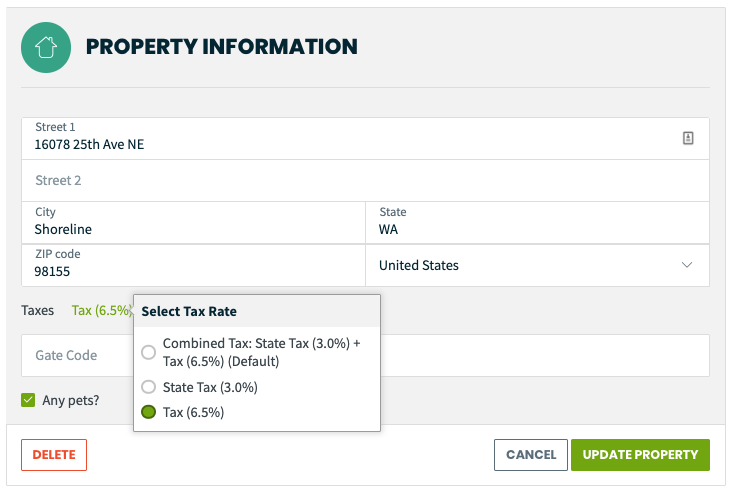

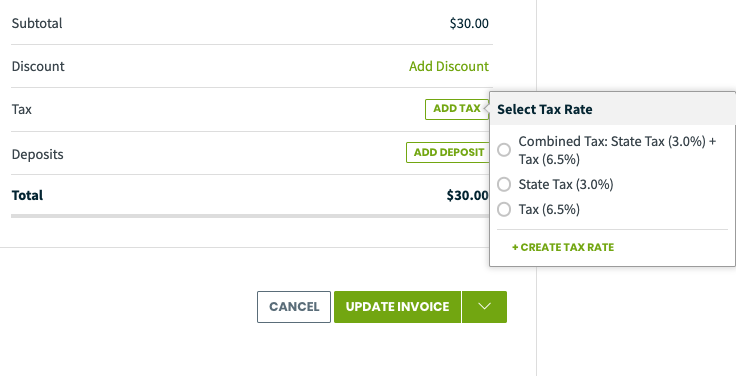

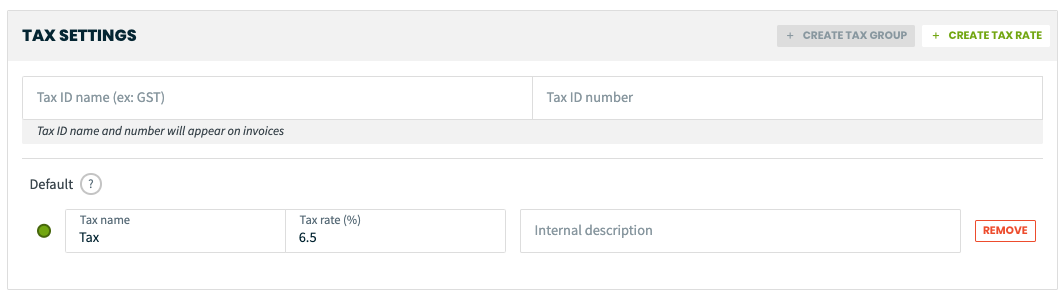

Tax Settings Jobber Help Center

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Ohio Income Tax Calculator Smartasset

Florida Sales Tax Rates By City

Tax Settings Jobber Help Center

Why Do Blue States Have Higher Effective Tax Rate Than Red States Quora

The Ultimate Guide To North Carolina Property Taxes

Tax Settings Jobber Help Center

Florida Property Tax H R Block

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Ohio Department Of Taxation Facebook

Sales Tax Holidays Alabama Department Of Revenue

Vehicle Taxes Department Of Taxation

Why Do Blue States Have Higher Effective Tax Rate Than Red States Quora

Tax Settings Jobber Help Center